Eligibility for the Disability Tax Credit is not based on a specific illness, condition or disability, but the degree and consistency to which the impairment affects an individual in the essential activities of daily living. This can represent a challenge for people with mental illnesses whose affects are less visual, but no less significant.

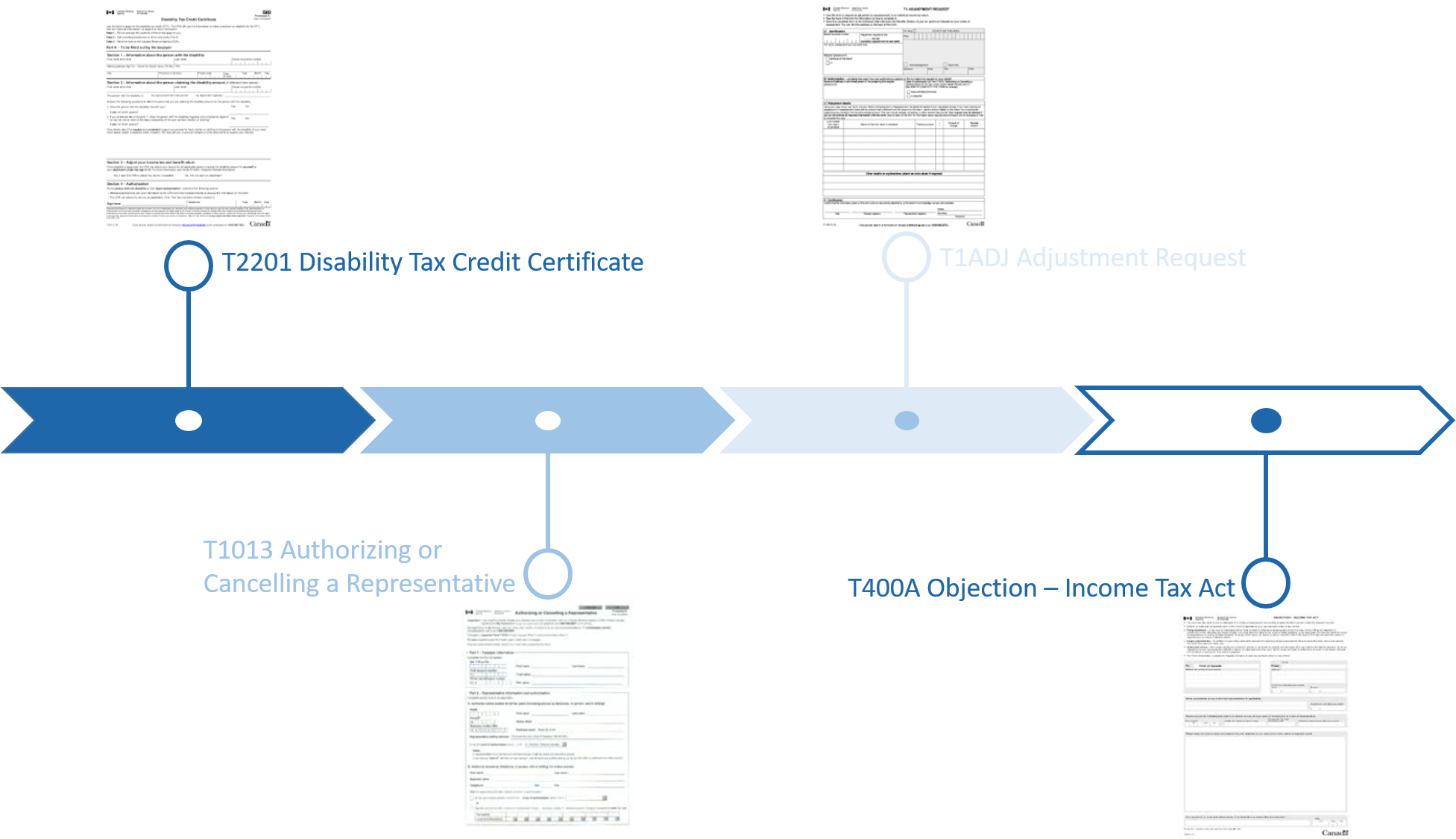

To apply for the DTC a T2201 must be completed, signed, and submitted by the disabled individual, or their legal representative, and certified by a relevant medical practitioner.

CRA provides helpful self-assessment questionnaires within Disability-Related Information 2017 (RC4064) and online .

If the disability has lasted, or is expected to last, for a continuous 12 month period in addition to “Yes” answers to any one of questions 2-5 on the self-assessment questionnaire in RC4064 the individual may be eligible.

Mental functions necessary for everyday life are considered basic activity of daily living, and are referenced in questions 4 & 5.

Question 4 states that the impairment must cause the individual to be “markedly restricted at least 90% of the time in one or more of the following basic activities of daily living”. As mention in my previous post Mental Illness and the Disability Tax Credit this may not be consistent with the reality of how mental illness is experienced.

Question 5 requires that the individual be “significantly restricted in two or more of the basic activities of daily living”, with the same 90% threshold and that “the cumulative effect of these significant restrictions is equal to being markedly restricted in one basic activity of daily living.”

One of the key things to focus on is the distinction between markedly restricted in question 4 and significantly restricted in question 5.

Markedly restricted means “it takes you an inordinate amount of time to do one or more of the basic activities of daily living, even with therapy and the use of appropriate devices and medication.”

Individuals that are significantly restricted “do not quite meet the criteria for markedly restricted, your vision or ability to do a basic activity of daily living is still greatly restricted all or substantially all of the time (at least 90% of the time).”

RC4064 provides a number of Examples and Notes to clarify what “mental functions for everyday life” means.

The key takeaway is that individuals with mental illnesses can qualify for the DTC even if they are able to function independently some of the time. Factors bolstering the case for claim approval include the inability to make decisions, express needs, problem solve, goal set, memory and self-care.

The credit itself can be claimed by the disabled individual themselves. It may also be claimed by taxpayers with a disabled dependent under age 18, a disabled spouse or common law partner or dependent children over 18.

All questions in Part B require the relevant medical practitioner to certify when the individual became markedly restricted in the activities of daily living. This determination is very important. Past tax returns for the individual or their parent/caregiver can be adjusted to reflect the DTC all the way back to that year, reducing taxes paid and potentially triggering a refund.

This adjustment will be completed automatically for the disabled individual or their parent(s) if the “Yes” box is checked in Section 3 of T2201. If the credit is being claimed on behalf of a dependent older than 18 years or a spouse/common law partner, the claimant will need to complete and submit a T1-ADJ for each year the DTC is available with the T2201.

Others may act on behalf of a disabled individual when applying for the DTC without being a legal representative provided the disabled individual provides authorization by completing T1013.

Once completed send the forms to relevant tax office.

If the DTC claim is approved a Notice of Determination will be issued. This document details the period for which the individual is eligible and includes information on eligibility for other programs dependent on the Disability Tax Credit. It will also explain reasons for rejection.

If the claim is rejected there are two options:

- Write your tax office and ask for a review: Be sure to include any further medical documentation not included in the original claim that focuses on the how the disability affects the activities of daily living.

- Formally object: Complete T400A and submit it your tax office within 90 days of the mailing date of the Notice of Determination.